ev charger tax credit form

This tax credit covers 30 up to 1000. Youll need to know your tax liability to calculate the credit.

Residential Charging Station Tax Credit Evocharge

Complete your full tax return then fill in form 8911.

. Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30 of the cost. Residential installations could have received a credit of up to 1000. With the passage of the IRA the maximum.

Businesses and individuals are eligible for an income tax credit of 50 of the equipment and labor costs for the conversion of qualified AFVs up to 19000 per vehicle. Were EV charging pros not CPAs so we recommend getting. A tax credit is also.

Complete or file this form if their only source for this credit is a partnership or S corporation. Figured it out. The federal tax credit for EV charger projects was retroactive and you could have applied it to installations from.

The Alternative Fuel Vehicle Refueling Property Credit like all federal tax credits does not reduce your state taxable income. How to get the Federal Tax Credit for EV Chargers. Instead they can report this credit directly on line 1s in Part III of Form 3800 General.

Tax Credit on Vehicle Home EV Chargers - IRS Form 8911. Youll need to know your tax liability to calculate the credit. The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended retroactively through 12312032.

2021 is the last year to claim a tax credit on the installation of your plug-in electric vehicle. For residential installations the IRS caps the tax credit at 1000. However under the new law if you complete the business installation project after 2022 the tax credit per property item is up to 100000 per EV charger.

Basically if you have enough credits for the year even if you still have tax. Complete your full tax return then fill in form 8911. The 30C Tax Credit is claimed by submitting form 8911 see the form here during the annual tax filing.

For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of 30000. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. Depending on the county in which they live.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. The credit attributable to depreciable property refueling. Were EV charging pros not CPAs so we recommend getting advice from.

Another aspect of tax credits for EV charging and other sustainability measures is that often the amount of rebate offered is dependent upon a time limit or by how many rebates have been. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Plug-In Electric Drive Vehicle Credit IRC 30D The 30D a credit is claimed on Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit Including Qualified Two- or.

Several states including Louisiana and Oregon offer their own tax incentive for charging equipment installation so if you file Form 8911 with the IRS you may be able to take advantage of a similar credit on your state tax return. This video covers how to. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of this writing.

Electric Vehicle Charging Is A Growing Credit Card Rewards Category Bankrate

How To Choose The Right Ev Charger For You Forbes Wheels

Ev Charging Stations 101 Wright Hennepin

Sono Motors Sion Specifications Everything You Need To Know In 2022 Solar Car Ev Cars Car Manufacturers

Ev Charging Tacoma Public Utilities

Tax Credit For Electric Vehicle Chargers Enel X Way

How To Choose The Right Ev Charger For You Forbes Wheels

How To Develop An Ev Charging Station App Cronj

How To Claim An Electric Vehicle Tax Credit Enel X

Blink Ecotality By Frog Design Devices Design Design Machine Design

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Fuseproject Product Ge Wattstation Electric Car Charger Charger Car Electric Cars

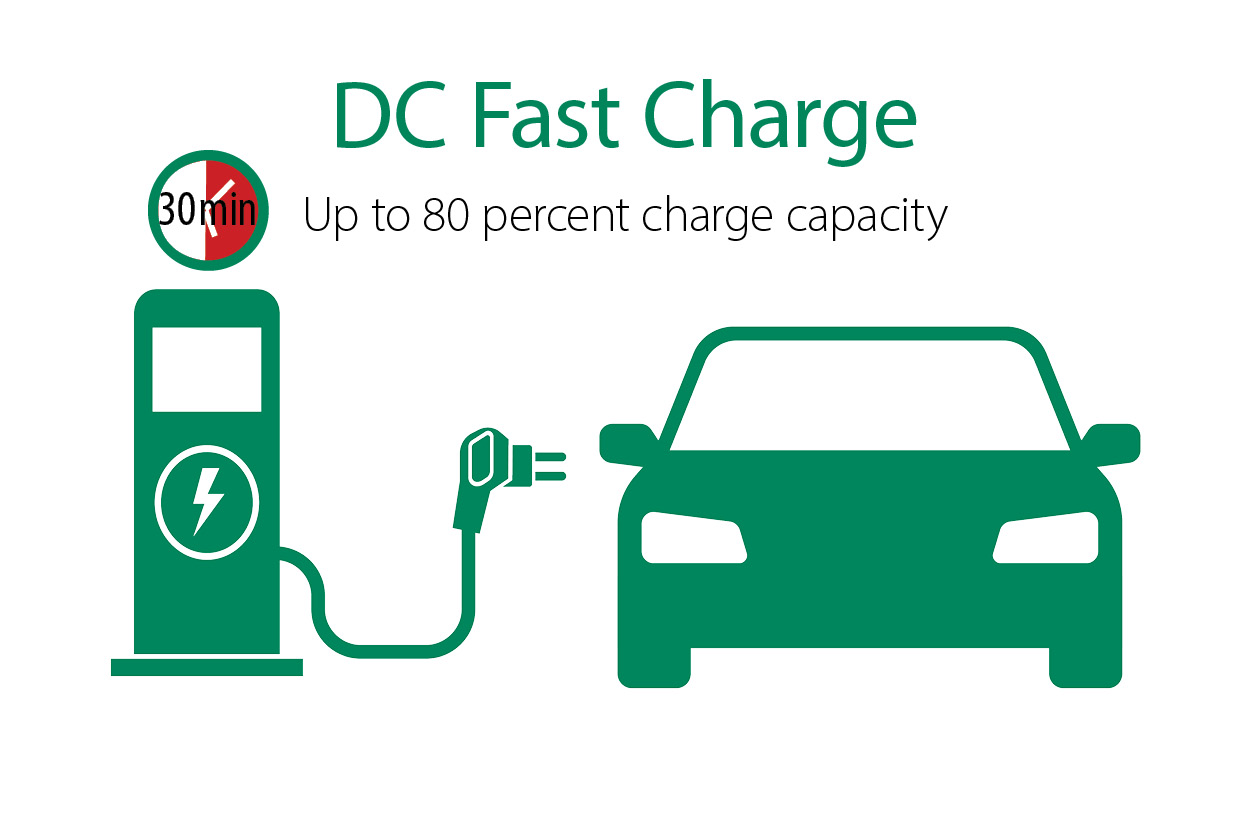

What Is Ev Charging How Does It Work Evocharge

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Vehicle Charger Installation

Commercial Ev Charging Incentives In 2022 Revision Energy

How To Claim Your Federal Tax Credit For Home Charging Chargepoint